Read More

Read More

Imagine making a contribution that leaves a legacy to Michigan State University College of Veterinary Medicine for generations to come.

This lasting impact can easily be made through the establishment of an endowment. Considered to be one of the most advantageous sources of funding, endowments enable the university to attract excellent students, support exceptional faculty, and expand and develop new programs by providing a steady, consistent, and perpetual source of income. This steady stream of funding ensures the University’s needs to recruit and retain the best and brightest students and faculty are met, while providing access to the most contemporary education possible.

How Endowments Work

Endowed funds differ from others in that the total amount of the gift is invested. Each year, only a portion of the income earned is spent while the remainder is added to the principal for growth. In this respect, an endowment is a perpetual gift.

Endowments are an excellent way to permanently honor your family, a mentor, or a loved one. Once you have created an endowment, your gift becomes part of our heritage and tradition. In fact, loved ones may also choose to support your fund because they know how special it is to you.

Both cash and planned gifts may be designated as expendable gifts for an existing endowed fund or to establish a new endowed fund. Currently, the minimum amount to establish a new endowment is $50,000. This can be in the form of a pledge or a bequest.

Outright Gift

Make an Immediate Difference

You can meet some of our most pressing needs by donating cash.

- It’s easy to set up

- You potentially receive the maximum tax deduction

- You will see the immediate effects of your generosity

Bargain Sale

Create a Double Advantage

With a bargain sale, you sell real estate or other appreciated assets for less than fair market value to us.

The difference between the actual value and the sale price is the gift, for which you are eligible to receive tax benefits.

Charitable Lead Trust

Protect Your Heirs’ Inheritance

If your estate is at a taxable level, this is a powerful way to pass more to your heirs and make a gift to us. How it works:

- You transfer assets into a lead trust

- The trust pays us for a specified term

- At the end of the term, the principal passes to your heirs with reduced tax liability

Bequest

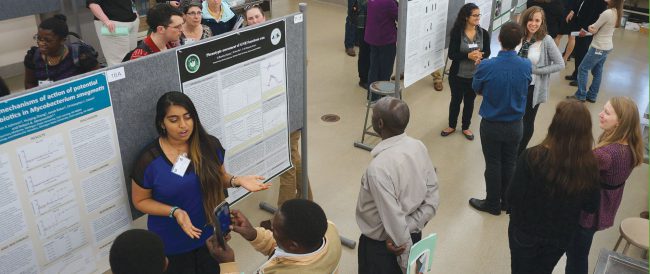

Endowments can be targeted to support any area or function of the College. Currently, student scholarships are a focus of the College and many donors.

Create a Legacy with Your Will

A donation in your will or living trust, called a bequest, allows you to support our work without parting with assets today. Some advantages include:

- Simple to set up

- Can be changed at any time

- Could provide estate tax relief

Beneficiary Designation

Create a Simple, Yet Powerful Gift

Everyone wins when you name us as the beneficiary to your retirement plan assets, life insurance, or insurance annuities.

- You can leave other, less-taxed assets to your family

- You can also change your mind at any time

- Our organization can put the full amount of your gift to good work

Retained Life Estate

For more information on existing endowments, or to establish a legacy gift of your own in memory or in honor of someone near and dear, please contact the MSU CVM Development and Alumni Relations at 517-353-4937 or email development@cvm.msu.edu.

Leverage a House for Your Benefit and Ours

Did you know that you can donate your house to us, but retain the right to live in it for the rest of your life? Here are some advantages:

- You receive an income tax deduction

- You will avoid the hassle of selling the real estate

- You will feel satisfied knowing that your gift supports our mission